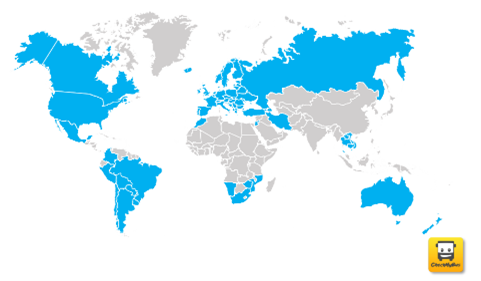

CheckMyBus, a global search engine for intercity and airport bus tickets, organized a survey with bus operators in 28 countries from the Intercity, Airport, and Charter segments.

CheckMyBus concludes from this that the bus market is experiencing titanic changes and opportunities at a very fast rate such as “Dynamic pricing” which is seen as important.

In the executive summary it is mentioned that the traditional offline business model is still dominant worldwide, while at the same time new digital operators, platforms, and technology providers have entered the market and are beginning to disrupt traditional operations and capture market share. At the same time, new business models are entering the market, which blur the segments of intercity bus, charter, and on-demand solutions. These new models are creating new offers and flexibility for consumers and are attacking already existing price levels.

Also consumer behaviour changed immensely in the past two years, shifting a >85% offline market much more quickly to online as would have been expected in a non-COVID 2019 but is helped by cities and governments that are pushing towards more sustainable modes of mobility.

Distribution

Operators have a clear desire to push their own branded channels. With a 5,6 out of 6, each brand’s individual company websites rank number 1 in sales channel importance, while other online changes averaged 3 to 4 out of 6. The top ranked goals in marketing were to strengthen their own brand and make customers loyal.

Pricing Strategy

Dynamic pricing is seen as important now and also a key need in the future (4,4 out of 6 now, rising to 5,4 in 3 years). This is important in this survey as most companies differentiate less on price but more on other benefits such as service, brand, and ease of use. Only about a third use tools for forecasting or market research on routes or competition benchmarking.

Technology Investment

Only half of companies surveyed plan to invest in their tools, which is on equal footing for the network/inventory management, demand/price planning, and e-commerce/marketing solutions. Today ancillary has a medium level of relevance in general and across all areas. Better seats and loyalty schemes have been dominant. While averages are small, selected players see high priority.